Gaming and Betting M&A: Taking a punt on the B2B value chain

With the business-to-business (B2B) value chain expecting to see continued growth and further consolidation over the next five years, the sector is ripe for investment.

Ongoing regulation of online sports betting in the US has injected a new vigour in the global M&A landscape for gaming and betting, with new partnerships and mergers rumoured or announced almost daily. This growth in the business-to-consumer (B2C) segment is driving growth and investor interest in the B2B value chain that supports the industry. For investors, there are a range of attractive businesses to suit almost any investment strategy.

A look at the B2B market

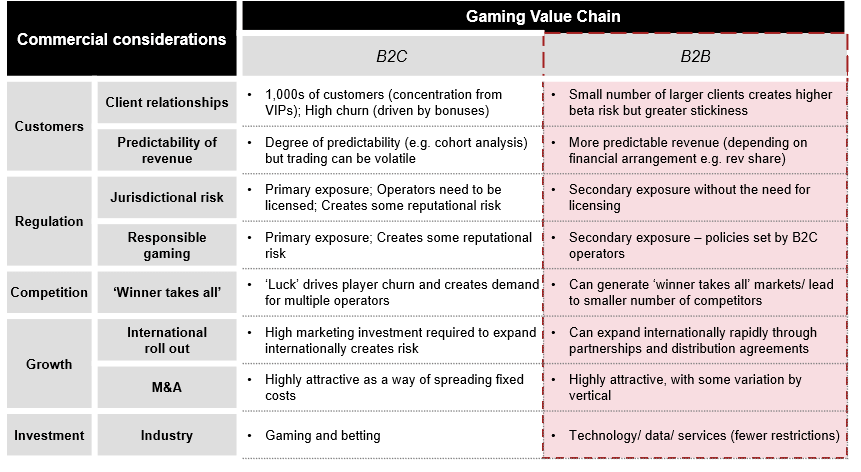

There are a number of characteristics that make investing in companies in the B2B value chain attractive. While B2B companies usually have fewer customers than B2C companies (which can present some beta risk), they tend to have greater predictability of revenue. They offer less direct exposure to regulatory and responsible gaming risk, and tend not to require local licensing. Dynamics vary across the value chain, however, you tend to find few sizable competitors within each segment and in some cases, one or two competitors can maintain 50% or more market share. Further, in terms of growth, partnerships and distribution agreements enable businesses to rapidly scale internationally, which can be accelerated through M&A.

For institutional investors, there are often fewer restrictions on investment as companies in the space are not considered gaming or betting businesses. This makes the B2B sector an attractive consideration for a much wider pool of investors.

Attractive margins and opportunity for growth

The gaming and betting value chain is complex and includes suppliers with varying capabilities, growth drivers, revenue streams and cost bases. Four of the largest segments - including game developers, sports data providers, platform businesses and affiliates - offer some common themes that make them particularly attractive.

All have benefitted, often through revenue share arrangements, from high growth in the B2C segment (3% p.a. overall and 11% p.a. online), driven by ongoing market regulation in the US and beyond. Further, many businesses in these segments benefit from similar positive characteristics as wider technology, data and content providers, which underpin attractive margins (30-60% EBIDTA for scale operators), and by developing new products and extending offerings have managed to offset margin pressures from operator consolidation.

For investors, the other attraction of B2B assets is their ability to present opportunities for a ‘buy-and-build’ strategy. ‘Add-on’ acquisitions enable the platform investment to broaden its product set for clients and present partnership opportunities to cross-sell to the other’s customers.

What to consider

Investors should think about which businesses within the value chain best reflect their own investment experience and portfolio strategy. For example, some investors will gain greater comfort from a more creative game developer that continues to release exciting new games. Others may prefer the ‘secret sauce’ and marketing capabilities that enable an affiliate to consistently deliver high volumes of converting leads.

Regardless of type, those businesses with (exposure to) a strong online and particularly mobile offering, as well as a presence in fast-growing, fast-regulating online markets (e.g. US, Canada, Brazil, Argentina, Germany, Netherlands) are likely to perform particularly well.

Contact us

Value Creation / Commercial Due Diligence Director, PwC United Kingdom

Tel: +44 (0)7802 659223