UK M&A activity for the first half down year-to-year but demand remains - PwC

20 Jul 2023

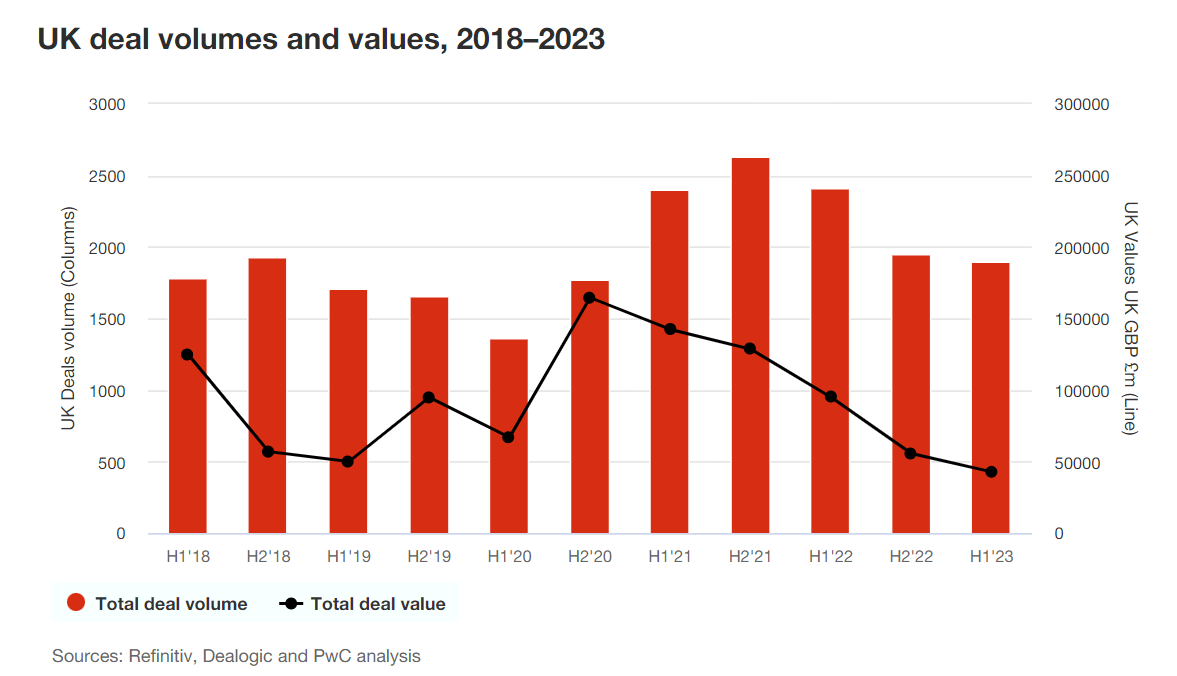

M&A activity in the UK for the first half of 2023 (H1’23) has fallen in comparison to the same period last year as macroeconomic headwinds and tight financing markets continue to affect the volume of deals completed, according to PwC’s latest Global M&A Industry Trends report.

In total the UK saw 1,902 deals in H1’23, compared to 2,408 over the same period last year, a 21% decline. While year-on-year volume is down, deal activity is still at or above 2018-2019 levels , pre-covid.

The analysis shows there was a total of £42.8bn worth of UK deals in H1’23 compared with £95bn in H1’22 a 55% drop in value, with fewer larger deals and a decline in average deal size. The number of deals greater than £1bn in value dropped from 19 with a combined value of £46.7bn in H1’22 to seven deals with a combined value of £15.4bn in H1’23. Mid-market deals activity has remained more resilient, as smaller deals are proving easier to get done in today’s difficult financing and regulatory environment.

Lucy Stapleton, head of deals at PwC UK, said:

“The UK experienced a tough transactions market during the first half of the year as conditions to complete deals, particularly high value ones remained volatile. Gaps in valuations between buyers and sellers continued to feed uncertainty and high interest rates made financing deals difficult. Despite this, activity in H1‘23 has been resilient and while in terms of volume we are not seeing the record levels compared to the same period last year, they are still roughly around pre-pandemic levels.

“In spite of the macroeconomic backdrop dealmakers remain optimistic and there is pent up demand amongst dealmakers who remain poised to deploy capital when market conditions begin to stabilise and valuation gaps narrow. The mid-market is continuing to hold up as cash-rich corporates look for strategic opportunities and we may see more bolt-on transactions as well as sell-sides as private equity and corporates start to prepare to exit businesses.”

“As we enter the second half of the year dealmakers will be looking to invest while the market is not at its buoyant best to maximise returns and a number of investment committees will be waiting to see how generative AI is disrupting their industries and the investment opportunities this may present. How deals are structured will also be key, we are seeing more creativity because of the current conditions whether that involves putting in more equity or finding sustainable financing to get deals over the line.”

Industry M&A trends

A breakdown of UK deal activity by industry for the first half of the year shows Technology, Media and Telecommunications (TMT) saw the most M&A activity (511), accounting for just over a quarter (27%) of the total for H1’23 followed by Industrial, Manufacturing and Automotive (466) and Consumer Markets (393).

The Financial Services industry saw deals with the highest value for the first half of the year, making up almost a quarter of total value with £10.2bn worth of transactions. TMT followed closely behind with £10.1bn, then Energy, Utilities and Resources with £8.1bn.

Tim Allen, deals industries and international leader at PwC UK, said:

“M&A activity within the industries was driven by opportunities linked to addressable market trends such as demographic change, technology advancement with the growth of generative AI and energy transition. This is evident from some of the deals we have seen involving fibre network investment in infrastructure and AI investment in the healthcare sector.”

Private Equity

Of the 1,902 deals in the first half of the year 39% involved Private Equity, a slight increase compared to the same period last year of 37%. The analysis also showed that of the £42.8bn in deal values generated in H1’23, Private Equity accounted for 54%, slightly down from 55% for the first half of 2022.

Hugh Lloyd Ellis, Private Equity Leader at PwC UK, said:

“There are still record levels of dry powder within private equity and as we look towards the second half of the year, any sense of stability entering the market would see confidence return. We continue to see various bilateral situations, minority deals and public-to-private attempts with investors seeing value in our public markets as the UK continues to compare attractively against the dollar.”

Ends

Notes to editor

PwC’s Global M&A Industry Trends is a semi-annual analysis of global deals activity across seven industries — consumer markets (CM), energy, utilities and resources (EU&R), financial services (FS), health industries (HI), industrial manufacturing and automotive (IM&A), real estate (RE) and technology, media and telecommunications (TMT).

About the data: We have based our commentary on M&A trends on data provided by industry-recognised sources. Specifically, values and volumes referenced in this publication are based on officially announced transactions, excluding rumoured and withdrawn transactions, as provided by Refinitiv (LSEG) as of 30 June 2023 and as accessed on 3 July 2023. Certain adjustments have been made to the source information to align with PwC’s industry mapping, and it has been supplemented by additional information from S&P Capital IQ and our independent research and analysis.

Deal values are reported by Refinitiv (LSEG) in US$. We have used an average exchange rate for H1’23 (1 GBP = 1.2338 USD) to convert US$ amounts into GBP.

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 156 countries with over 295,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at PwC.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see how we are structured for further details.

© 2023 PwC. All rights reserved.