Miners capitalise on energy transition commodities, despite challenging road to net zero: PwC’s 20th annual Mine report

06 Jul 2023

2022 revenue of the top 40 mining companies remained stable at US$711bn

Governments increasing roles to secure critical mineral supply, swift uptick in last 12 months

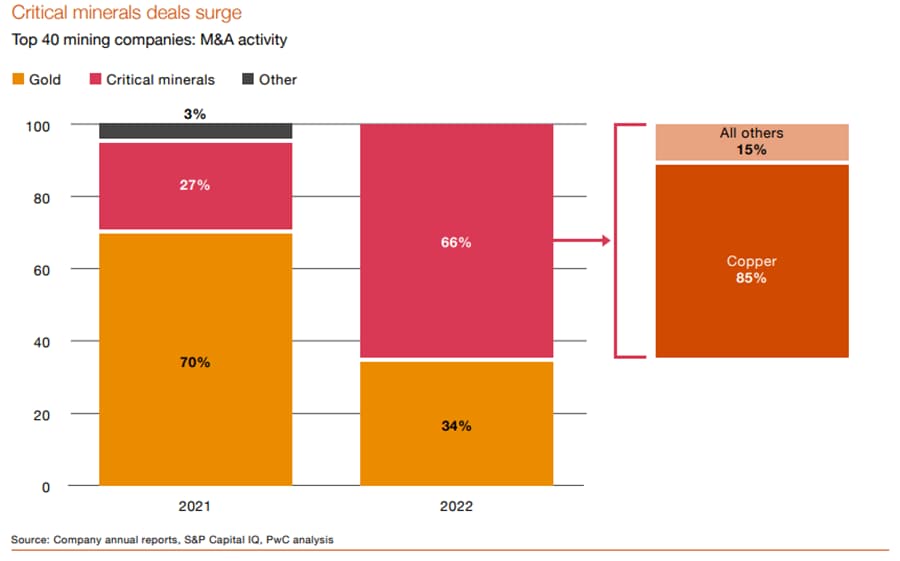

As demand for more mined critical minerals increases in a net-zero world, the flow of industry dealmaking clearly reflects this, with critical-mineral deals making up 66% of total Top 40 M&A in 2022

Coal, largest contributor to total revenues (28%) – the first time since 2010

Mining revenue held steady at US$711bn in 2022, in another year of strong financial performance, but rising costs and economic uncertainty squeezed EBITDA** margins from 32% to 29%, new PwC analysis into the sector has revealed.

In its 20th edition, PwC’s 2023 Mine: The era of reinvention, an annual review of the Top 40 mining companies globally, examined trends in the mining industry. In this report, PwC found market capitalisation of the Top 40 miners tripled from US$400bn in 2003 to US$1.2trn in 2022.

The findings of this year’s report capture major themes and developments impacting the industry, especially the impact of the energy transition, which will shape the industry over the coming two decades. Miners will have to navigate the increasing role governments--and new players like automobile companies--are playing in the sector, while simultaneously ensuring they are well-positioned for the clean energy transition - which requires access to resources.

Given ongoing geopolitical uncertainty, the rapid shift to clean-energy technologies and the importance of both these issues to national security and economic stability, governments around the world have taken swift action over the last 12 months to secure critical mineral supply and, in doing so, changed the playing field significantly. This includes swift action to form alliances, craft policies and laws, and fund initiatives that will help stabilise the supplies of critical minerals.

Paul Bendall, Global Mining Leader, Mining & Metals, PwC Australia, said:

“Mining is playing a fundamental role in underpinning the global transition to clean energy, but the path ahead is rocky. A net zero world requires more mined critical minerals, not less, and the flow of industry dealmaking clearly reflects this. But the increasing rise of geopolitics as an influencing factor in global mining may complicate operations in an increasingly complex world with new actors.”

Liz Hunt, Energy & Resources Sector Leader at PwC UK, said:

“Critical minerals are a vital component to the global energy transition, given their importance in developing many renewable energy products and technologies. Looking at it through a UK lens, we have to work with the geography of where mines are located, but the creation of resilient and agile supply chains is equally important.

“As demand grows, particularly for battery technologies, the future holds a huge opportunity for UK renewables and green investment funds in the onshoring of critical minerals. We’re seeing this already materialising with plans for the UK’s first lithium mine in Cornwall, for example.”

Critical minerals

Critical minerals dominated deal activity in 2022 as miners raced to capitalise on the global transition towards clean energy, driven by two forces. First, the role many of these minerals play in the clean energy transition technologies, such as batteries, electric vehicles, and solar and wind generation. Second, the role of critical minerals in national defence, technologies and weaponry.

In 2022, gold, copper, lithium, and cobalt exploration grew significantly, with the top 40 mining companies reporting higher spending on exploration than at any point since 2013. With increased demand, and limited supply for critical minerals, continued exploration investment for these minerals will be essential to the energy transition.

Recruiting the future

The mining industry needs talent to meet the growing demand for minerals and metals. They especially need talent who can work with advanced technologies that are integral to modern mine operations. PwC’s 26th Annual Global CEO Survey, showed almost two thirds of mining CEOs believed that skill shortages would have a large or very large impact on profitability over the next ten years. Attracting the industry’s next generation of talent needs a focus on the industry’s skills of the future: in artificial intelligence, robotics, automation and data analytics.

The mining workforce also exhibits wide gender gaps. According to the International Labour Organization (ILO), only 14% of executive mining jobs are held by women. While according to S&P Global, women only account for 12.3% of board positions at mining companies globally.

Liz Hunt, Energy & Resources Sector Leader at PwC UK, added:

“Our research with POWERful Women from earlier in the year showed that in the UK alone, women occupy less than a third (29%) of energy sector board seats (executive and non-executive) – 11% off the cross-sector target for the FTSE 350, which last year met its 2025 target of 40% women on the board. Whilst focused on the energy sector, the findings of this report have a direct read across to the mining sector, as this report shows that attracting new members of the workforce, as well as upskilling current employees is a critical issue across the global energy mix, regardless of sub-sector.

“The energy transition brings with it a need to grow the sector’s workforce and with it, attract diverse and varied skill sets, and this report continues to highlight the importance of attracting diverse and varied skill sets, especially considering the growing impact of digital technologies on modern mining practices.”

Decarbonisation

According to PwC’s 2022 survey of more than 4,000 CEOs globally, over one-third of mining CEOs (35%) see their company as highly or extremely exposed to climate-related risks within the next five years. Despite the global goal to reduce carbon emissions, this year’s Mine report found that the geopolitical instability of 2022 saw demand for coal surge, making coal the largest contributor to Top 40 revenue at 28%.

Although there will continue to be a role for thermal coal in meeting global energy needs for the foreseeable future, and the path to net zero will not see linear year-on-year reductions in coal use, the trajectory for coal is down. Despite coal’s growth this year, PwC Mining leaders forecast coal revenue will fall in 2023 as supply increases and demand has normalised. The number of Top 40 miners with coal revenues declined from 19 in 2012 to 11 in 2022.

Among the most cost-efficient options for decarbonisation in the industry include direct electrification, efficiency improvement, and renewable energy, followed by hydrogen power for applications that cannot be electrified.

Mergers and Acquisitions

While the total value of Top 40 M&A was steady in 2022 compared to 2021, the composition of those deals changed significantly. Critical-mineral deal value increased by 151% compared to 2021, making 66% of total deal value over the year. Gold deals, on the other hand, fell by 50%, possibly signalling the end of the precious metal’s dominance of M&A over the past several years.

Copper was 2022’s hot commodity, representing 85% of all critical mineral transactions and 56% of total Top 40 M&A. As a crucial metal in the shift towards sustainable energy, copper is expected to remain in high demand as renewable energy sources take priority.

Miners will also need to work with other industries, such as car companies and battery manufacturers as original equipment manufacturers (OEMs), through joint ventures, partnerships and offtake agreements to secure supply. As governments incentivise the production and processing of critical minerals, we expect OEMs to make more direct investments in mining and processing assets, increasing the competitive landscape for growth assets and M&A.

Paul Bendall, Global Leader, Mining & Metals, PwC Australia, added:

“Critical minerals will be vital for society and the mining industry over the next 20 years. War, climate change and the technological revolution are putting mining firmly at the heart of the world’s new geopolitical landscape. The industry must continue to decarbonise while also adapting to a mining environment that may be hotter, harsher and central to driving the net zero economy. If there’s one industry above all else that’s critical to a net-zero future, it’s mining.”

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 156 countries with over 295,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at PwC.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see how we are structured for further details.

© 2023 PwC. All rights reserved.