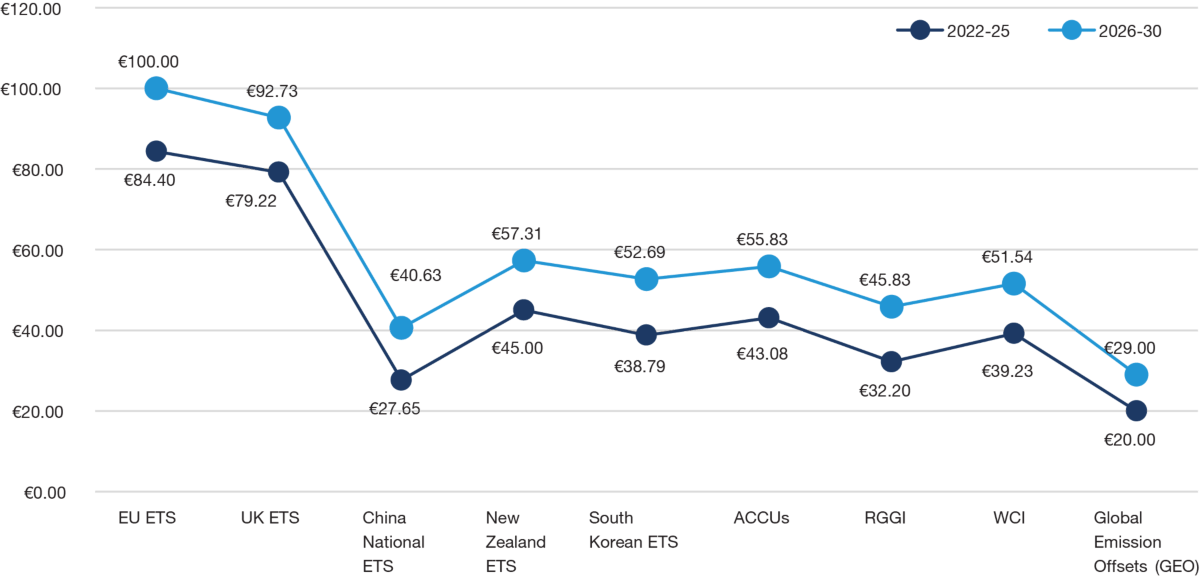

The results from this year's survey indicate that while prices are still expected to increase across all ETSs, the extent of the increase is less than what was anticipated in last year’s survey. Participants have become more cautious across almost all markets, and the expected prices for the 2023-2025 and 2026-2030 periods have decreased for every emissions trading system included in the survey, except for the EU ETS price in the period 2026-2030, which has remained at €100t/CO2 (£86). Nonetheless, the overall bullish sentiment expressed in the 2022 and 2021 surveys persists, as the long-term trend of rising prices across the systems remains. In several instances, prices have already surpassed or are in line with the projection made for the period 2026-2030 in last year's survey. For example, the EU ETS peaked at €100.34/tCO2 in February 2023, and the UK ETS hit £97.75/tCO2 (€115) in August 2022.

Consistent with last year, the EU and UK ETS have the highest expected average carbon prices of any ETS across both periods of 2023-25 and 2026-30, with prices expected to reach €100/tCO2 and €93/tCO2, respectively during the period 2026-30 for the systems.

The VCM has experienced accelerated growth in recent years, with the size of the market expected to reach $10 billion - $40 billion by 2030. According to respondents, the increase in demand for carbon credits has been primarily driven by an increase in corporate net zero pledges, demand due to compliance obligations from markets such as CORSIA which accept voluntary credits, difficulty in reducing GHG emissions from corporate value chains, and agreement to use offsets towards interim net zero targets.

The expected growth of the VCM over the next decade has brought about questions over whether the market will be able to accommodate the increase in demand. However, respondents remained optimistic, with 71% believing the VCM will be able to accommodate the growth in companies' net zero commitments and pledges to reduce emissions by 2030, a modest increase from 66% last year. Some respondents did raise concerns about the quality of credits and highlighted the need for clear rules on which credits are eligible for corporate entities to use.

The use of carbon credits by corporate entities has come under increased scrutiny in the past twelve months. In this year's survey, respondents reflected this sentiment by identifying public perception and negative press coverage as the two most significant challenges facing the VCM in the year. Respondents also identified the quality of carbon credits and uncertainty around corporate claims as major challenges facing the market. This comes as the Integrity Council for the Voluntary Carbon Market (ICVCM) release their Core Carbon Principles (CCPs) which set the new threshold for high-quality offsets, and the Voluntary Carbon Markets Integrity Initiative (VCMI) are set to release their operable Claims Code of Practice, which outline how companies can make transparent and credible claims in relation to their net zero commitments.

However, nearly half (44%) of respondents remained uncertain if the VCMI’s Code of Practice has the potential to improve the integrity of carbon credits within the VCM. The majority of respondents selected “maybe” (37%) or “yes” (34%) in response to whether they believe the ICVCM’s CCPs will improve the integrity of credits within the VCM and support the longevity of the market.

2023 is set be another important year for carbon markets - as the EU implements its Carbon Border Adjustment Mechanism, discussions are set to continue on how to operationalize Article 6, and ongoing regulatory reforms are expected in the voluntary and compliance market

The report’s authors would be very happy to discuss what this could mean for your business or organisation. If you are interested, please refer to the contacts below.