Our collaboration with Sage for the UK mid-sized market empowers businesses by integrating our established FMS solutions with the robust capabilities of Sage Intacct. This strategic partnership is a key component of our expanding Managed Services portfolio, where we work closely with clients to manage their operations and business processes, helping them achieve their strategic goals.

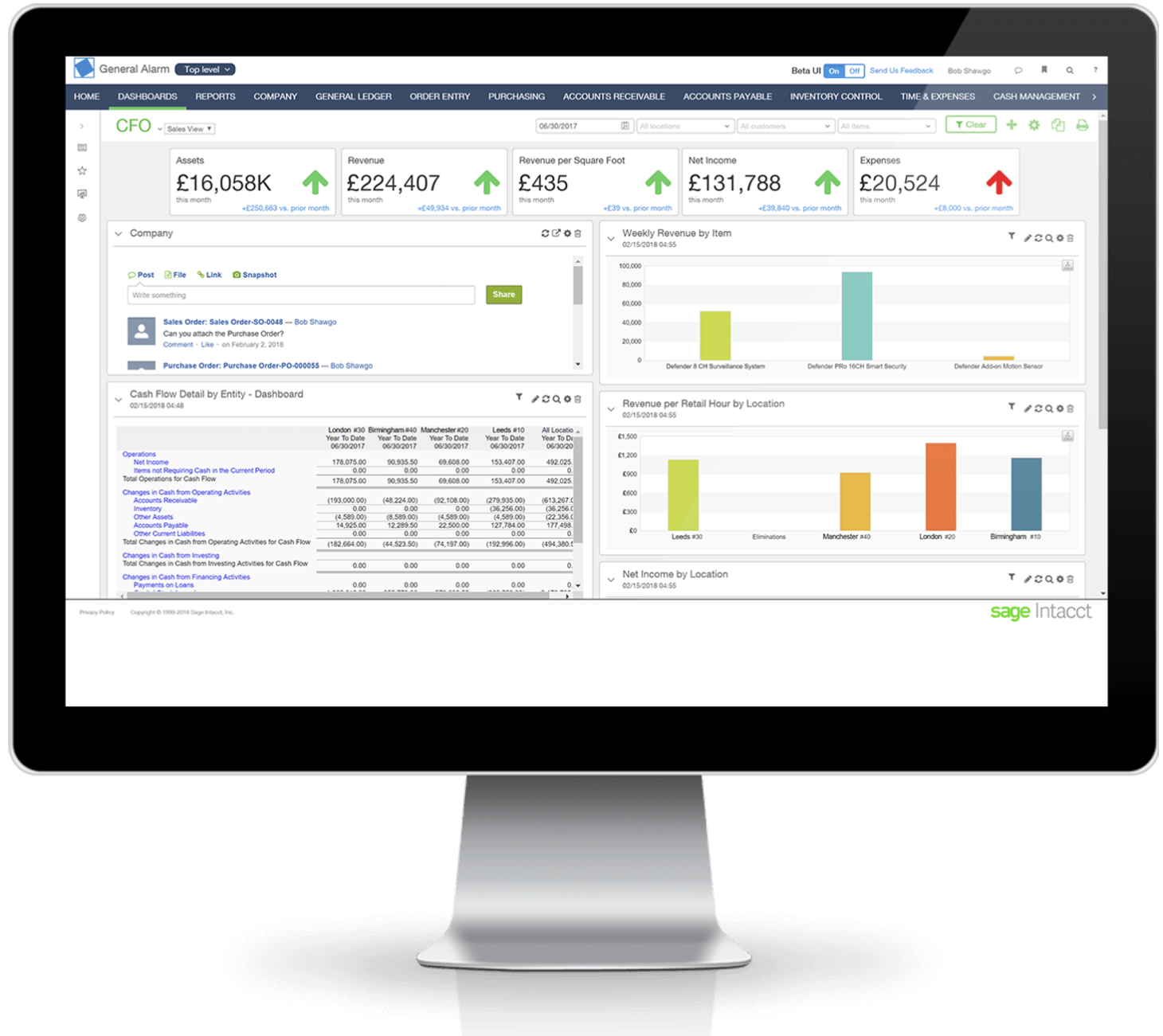

With Sage Intacct, we offer a fully configured platform that allows for the rapid deployment of an FMS functioning as a comprehensive ‘one-stop shop’ for finance and compliance. Our services encompass the design, support, and complete provision of an end-to-end finance and tax function, including:

- Technology provision, operational management, and support with the delivery of accounting and compliance solutions.

- Management of finance and tax operations, focusing on:

- Financial controlling, including account reconciliations and management accounts.

- General Accounting.

- Non-BPO Operational Finance, such as Accounts Payable, Accounts Receivable, bank, and cash operations.

- Connected Tax Compliance, covering VAT, statutory accounts, and corporate tax.

- Payroll services.

- Preparation of management accounts and provision of insights.

- Global account coverage.

Organisations trust Sage's finance, HR, and payroll software to streamline work and financial flows. By digitising business processes and relationships with customers, suppliers, employees, banks, and governments, Sage’s digital network connects the dots for our clients, removing friction and delivering actionable insights. This integration of services ensures trust in your financial and management reporting by maintaining accuracy through connected services, robust processes, enhanced control measures, and digital audit trails. This leads to deeper insights from your data, all delivered by PwC.