From complexity to value: Reinventing compliance

PwC’s Global Compliance Survey 2025 explores how organisations can reinvent compliance and move from complexity to value.

PwC is the UK's leading tax service provider in terms of reputation, size and scope. We work with a diverse range of clients, including multinationals, public sector bodies, entrepreneurs, and family businesses. In today’s fast changing tax landscape where staying ahead is crucial, our team of experts can help your tax department adapt to future proof your business.

“We partner closely with our clients across a broad range of tax advisory and compliance services, supporting them to navigate complex tax environments. Our diverse team of specialists bring together leading-edge technology with deep technical expertise to provide tailored, high-quality advice and insights to solve our clients' most complex problems.”

We’re helping clients navigate complex tax and regulatory environments with a human-led, tech-powered approach. Stuart Higgins, Tax Markets and Services Leader, and Kerstine Rencourt, Tax ERP & Data Lead, talk about how we give clients greater confidence to make decisions through data and insight.

This is a modal window.

We’re helping clients navigate complex tax and regulatory environments with a human-led, tech-powered approach. Stuart Higgins, Tax Markets and Services Leader, and Kerstine Rencourt, Tax ERP & Data Lead, talk about how we give clients greater confidence to make decisions through data and insight.

View Transcript

PwC’s Global Compliance Survey 2025 explores how organisations can reinvent compliance and move from complexity to value.

In our annual publication we explore the transparency developments in both legislative and voluntary reporting, alongside how tax continues to be increasing integrated within the Environmental, Social and Governance agenda. We explore ways of building public trust through tax reporting.

The mid-market private equity space remains a robust and active deal environment, continuing to see significant activity. Over the past year, PwC’s Mid-Market tax team has been at the forefront of this dynamic market, advising on over 350 mid-market deals across a broad spectrum of sectors. Drawing from the deep experience of our leadership group, which boasts over 200 years of professional experience, this article highlights some common areas of focus for any businesses coming under private equity ownership and the associated tax implications.

On 26 March 2025, the Chancellor of the Exchequer Rachel Reeves will deliver a statement in Parliament providing an update on the Government’s growth mission, alongside the publication of an economic and fiscal forecast from the Office for Budget Responsibility (OBR).

In November 2024, HMRC released new compliance guidelines in relation to Patent Box claims, which were effective immediately. These guidelines summarise HMRC’s best practice advice and highlight the key areas HMRC expect businesses to consider before making Patent Box claims.

The FTT ruled that The Mersey Docks' quay wall qualifies as "plant" for capital allowances, challenging HMRC’s stance. This may impact infrastructure tax relief claims.

Our latest insights from across the Tax landscape

The article discusses the impact of pre-development costs on capital allowances in the UK, focusing on the Gunfleet Sands Ltd v HMRC case and the government's consultation to address related tax issues.

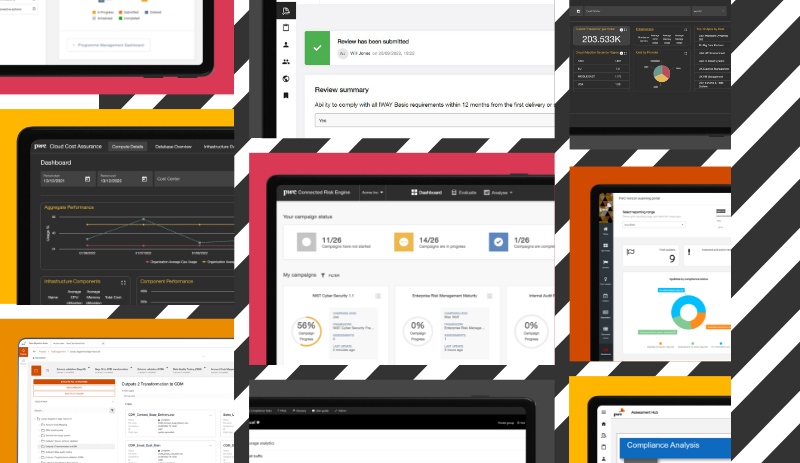

Today’s world is fast-moving, uncertain and unpredictable. Our digital products have been built to help better understand and navigate your business issues so that you can adapt and grow in the face of disruption.

Access extensive news, tools, and services to help you manage your Tax obligations more effectively. Stay updated on new developments, mitigate risks, boost productivity, and access in-depth research modules—all with a subscription plan that fits your needs.