A single solution to manage the complexities of global indirect tax compliance reporting.

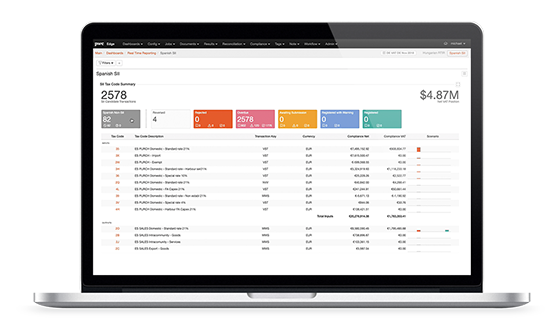

Indirect Tax Edge is a modular, data-analytics driven solution that manages period-end compliance reporting, transactional tax compliance as well as data and process quality management in a single global platform. Developed with business users in mind, this software features intuitive workflows, advanced analytics, exception management and self-service dashboards within an easy-to-use web application interface.

Against a backdrop of increased scrutiny from tax authorities and compliance regulators - Indirect Tax Edge gives you the added confidence that you are able to effectively review your transactional data to ensure it is correct and allows you to meet your traditional and real-time reporting obligations.

Indirect Tax Edge is backed by PwC’s global network, and is specifically designed as a future-proof and scalable platform that can grow with your business and adapt with the Indirect Tax global landscape, allowing you to start with your immediate compliance needs then expand and enhance your process when you are ready.

Indirect Tax Edge makes it easy to explore and extract meaningful insight from your tax data

Benefits of Indirect Tax Edge:

- Improved financial performance

- Reduction in effort

- Improve Governance, Risk & Controls

- Business process improvement

- Improve transactional data quality

- Greater Visibility & insight into your data

Improved financial performance

Prevent tax leakage.

Quicker refunds.

Detailed trending, variance and reconciliation functionalities.

Increased transparency for improvement and the identification of tax saving opportunities.

Address tax exceptions earlier in the business process.

Reduction in effort

Reduce effort for ongoing checks, rework and internal audits.

More effective use of existing staff & resources.

Seamless and automatic flow of source system data to the tax return.

Streamlined processes to increase efficiencies.

Intuitive user interface to enable increase usability and efficiency.

Single solution for effective data management and compliance reporting.

Improve Governance, Risk & Controls

Control your compliance obligations with greater efficiency, accuracy and flexibility.

Reduced risk, more coverage, delivered globally in a single place.

Transactional tax dashboards for greater insight into data.

Automated risk and compliance activities frees up focus for more important business risks.

Business process improvement

Automated Indirect Tax reporting on a single platform protects integrity of data, lowers the risk of human error and manages data access.

Complete workflow management.

Task ownership.

Automated processes reduce risk and allow your teams to run more efficiently.

Smart workflows drive corrections from source data.

Improve transactional data quality

End-to-end process quality and controls testing.

Automatic data quality checks.

Greater Visibility & insight into your data

Customised dashboards to provide valuable insights to system users and the wider business.

Detailed trending, variance and reconciliation functionalities.

Fact based insights from your transactional data.

Identify unique insights from your transactional data.

Indirect Tax Edge is a modular, flexible solution

From cost-effective solutions to full service roll-outs, Indirect Tax Edge is a modular platform that offers flexibility to support your business from simple usage through to complex global scenarios. Functionality can be enabled as required to effectively manage all of your local and global compliance reporting obligations, delivering enhanced management insights and control of operational tax risk.

Indirect Tax Edge can be rolled out for insource compliance solution, an outsource compliance solution or as a co-source compliance solution.

Indirect Tax Edge delivers all the features and functionality required to successfully manage your indirect tax compliance and reporting obligations from the one easy-to-use application

Contact us

Indirect Tax Compliance Services Leader, PwC United Kingdom

Tel: +44 (0)7843 289575

Indirect Tax Compliance Services Data Transformation & Analytics, PwC United Kingdom

Tel: +44 (0)7843 371211

Indirect Tax Compliance Services CoE Leader, PwC United Kingdom

Tel: +44 (0)7734 958646

Global Indirect Tax Compliance Services, PwC United Kingdom

Tel: +44 (0)7718 980783

Indirect Tax Compliance Services Markets, PwC United Kingdom

Tel: +44 (0)7703 562303