Operations consulting: Optimise your organisation and solve operational challenges to find and deliver growth opportunities

Transform your operations

There's never been a more critical time to optimise your assets and people to create competitive advantage. In a world where change is constant, you need to be leveraging the latest operational and digital tools to serve your customer and markets in the best possible way.

We have wealth of expertise executing programmes of work and have great client experiences to share. We'll help you pivot to new operations frameworks optimised to your business strategy and workforce need.

Operations consulting services

- Business and operating model transformation

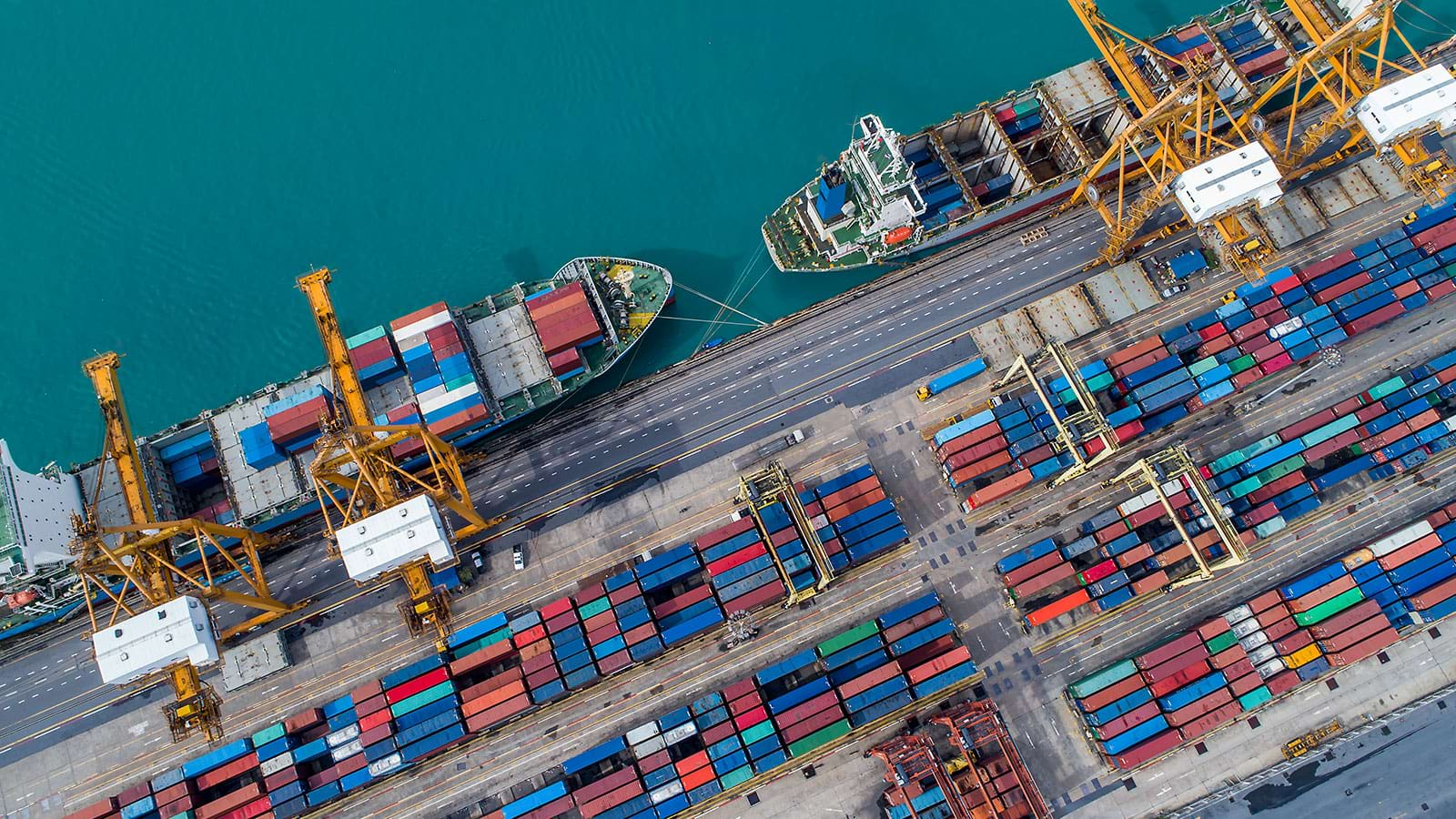

- Supply chain and procurement

- Supply Chain & Operations Managed Services

- Operations excellence and automation

- Asset lifecycle management

- Product development and innovation

- Perform Plus

Business and operating model transformation

The effectiveness of your operating model has a significant impact on whether your business achieves its overall strategic objectives. An effective business operating model will set you and your employees up for success, meeting customer, shareholder and other stakeholder needs.

We’ve helped organisations undergo operating model transformation with great success. With markets becoming tougher due to changes in customer behaviour, business disruption, increasing regulatory complexity and slow economic growth, it’s vital that your operating model is fit for purpose.

Beyond Change

People and organisations are facing change. You need an adviser that understands this change and provides certainty. One that can show your organisation what’s possible. One that reshapes your strategy and defines the skills and technology required to deliver the transformation you need. Whether refining or reinventing what you do, we’ll help you see beyond change, to opportunity.

Visit the Transformation hub

Insights and case studies

Work with us

Meet our people. See our work. Join our team.

Search and apply

“We're one of the world's leading professional services organisations. From 150 countries, we advise some of the world’s most successful organisations, as well as its most dynamic entrepreneurs and thriving private businesses. Join us and you’ll work closely with the best in industry, finance and government in the UK and abroad, bringing fresh insights and motivation to the problems they face.”